Cash-Out Refinance

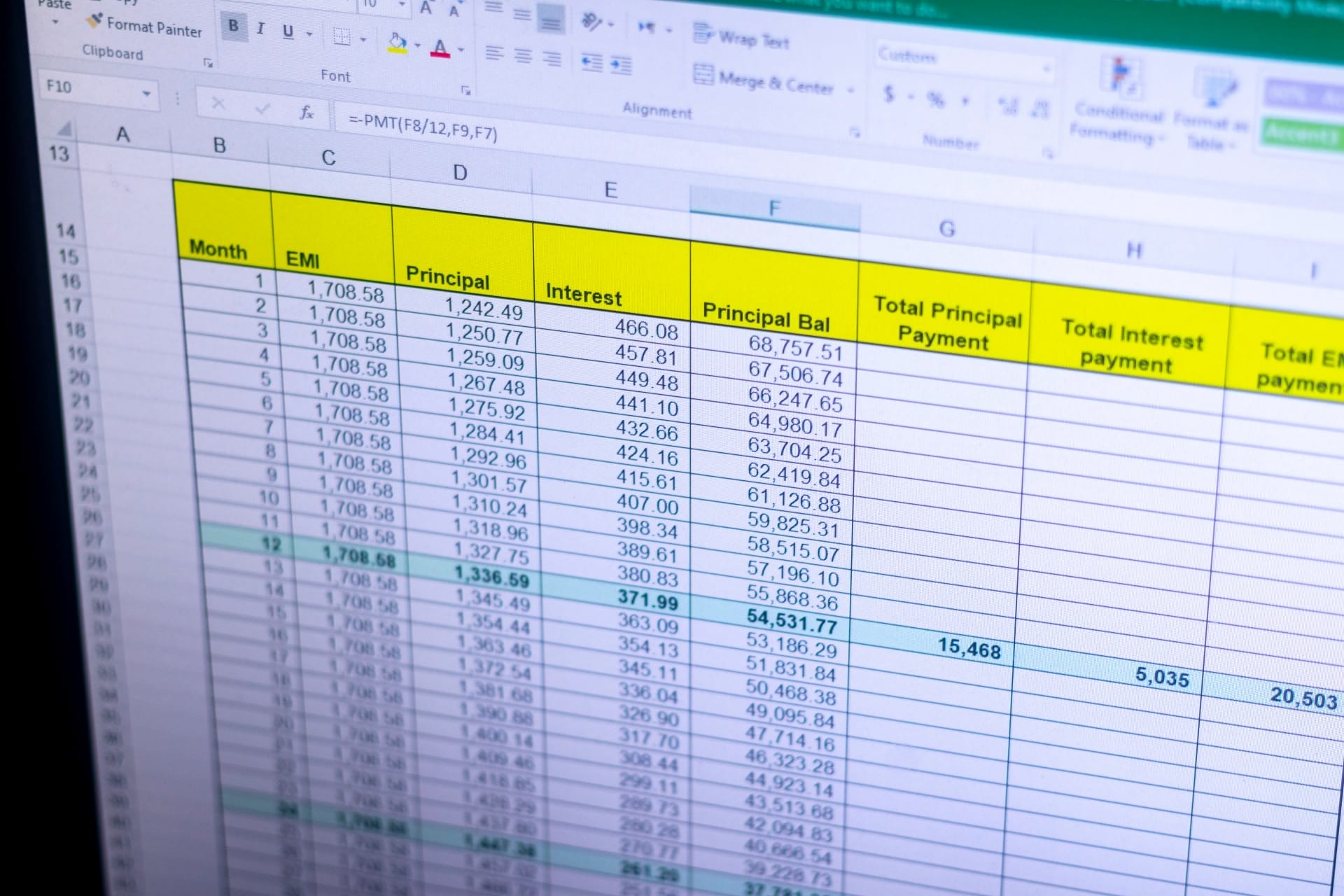

Cash-out refinancing is a strategic financial maneuver that empowers homeowners to unlock the potential value stored within their properties. It can be a valuable financial tool for those looking to leverage their home equity for various purposes. What Is Cash-Out Refinance? As mentioned, cash-out refinancing is a financial strategy utilized by homeowners to access the […]

Cash-Out Refinance Read More »