A REAL ESTATE FUND LIKE NO OTHER

Earn like an owner, without the burden or risk.

Login with Email

Please enter your username or email address. You will receive an email message to log in.

TARGETED IRR

25%

by year four

PROJECTED CASHFLOW

8-12%

starting year one

FLEXIBLE TERMS

Year 3

option to exit

You want what every real estate investor wants:

income now, and appreciation over time.

But direct ownership brings headaches—tenants, repairs, debt—and eventually, the upside feels like too much work. Traditional funds don’t help much either: low payouts, long holds, no cash flow. And most other options? Too complex, too restrictive, or not worth it.

Meet Adam,

our founder.

“As a third-generation real estate developer, I built the fund I wanted for my own retirement.”

What sets us apart.

Our money’s in the fund too. In fact, we’re the largest investors, so these are our non-negotiables:

When one asset slows, another is gaining ground.

Our portfolio spans build-to-rent communities, self-storage, and short-term rentals—chosen for their resilience, cash flow potential, and ability to perform across market cycles. Think of it like a high-yielding mutual fund for real estate—built to deliver in more than one lane at a time.

When you own every step, you never wait to act.

We oversee acquisition, development, and operations in-house—so we can move fast, hold or exit at the right time, and capture opportunities others miss. In a seller’s market, we build and sell. In a buyer’s market, we buy. That flexibility only works when you own the process.

Execution is the edge—and we’ve earned it.

With decades of experience and billions in managed projects, our team knows what holds up. We stress-test every deal quarterly, manage leverage with discipline, and invest in resilient assets with multiple exit strategies. Risk mitigation isn’t a box we check just once—it’s something we manage daily, from the inside out.

It looks like a fund, but it pays like you own the place.

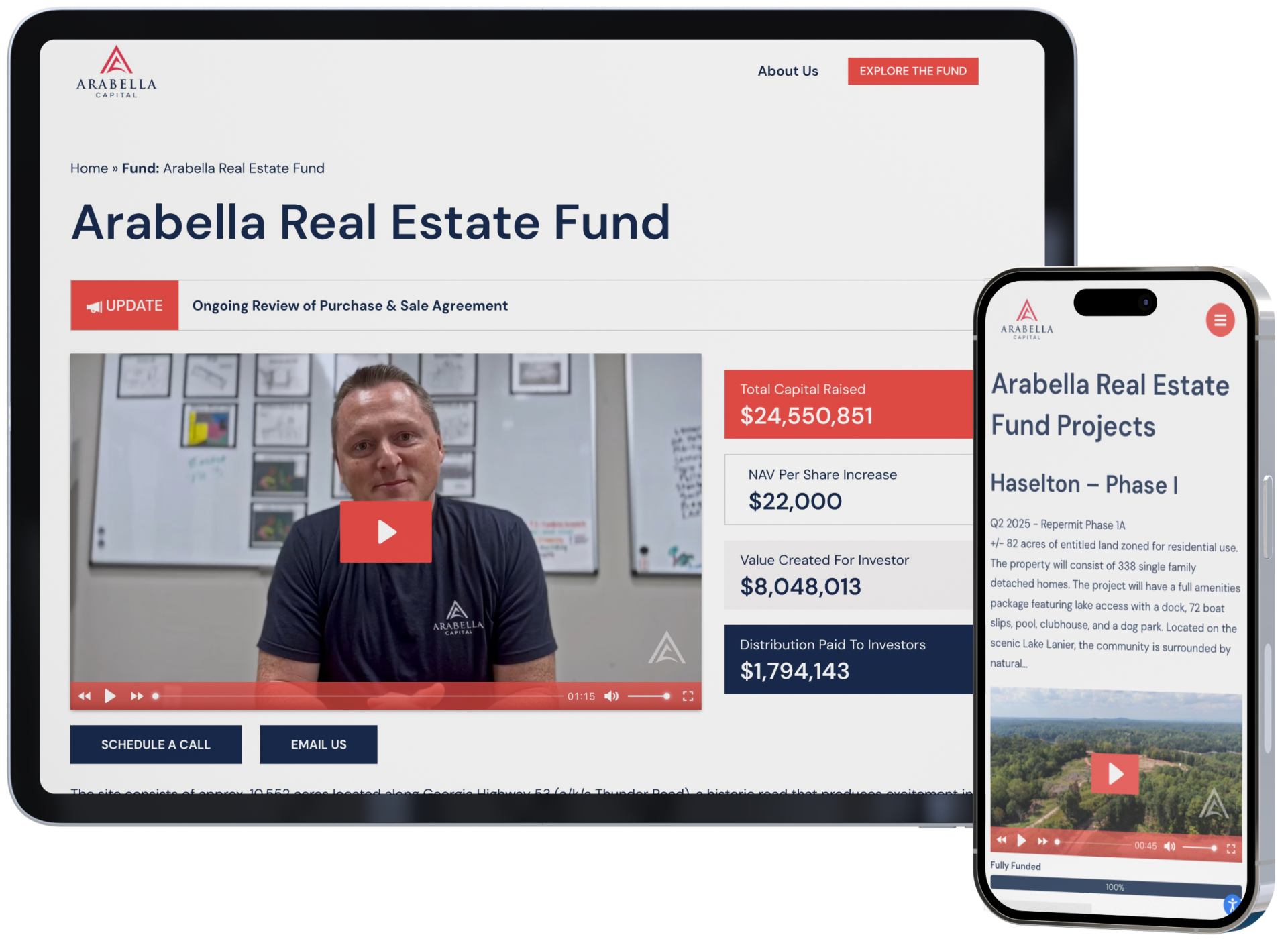

Arabella delivers what most funds can’t: steady income from day one and real appreciation over time. Investors receive quarterly distributions totaling 7–8% annually while share values rise across a diversified portfolio. With a target 25% IRR by year four and the flexibility to exit after year three, it’s built for people who want results—without the wait, and without the work.

that helped us reinvest. You all are great to

work with!

able to invest a portion of my Traditional IRA funds.

All of your efforts are MUCH appreciated!

thorough following up with this whole process of

investing. I look forward to investing more and

growing together successfully in our future.

level and quality of communication. I’m very

glad to be invested in your fund.

Asset Allocation in the Current Pipeline

At any given time, our portfolio includes projects in different phases—acquisition, development, stabilization, and exit. That’s by design. This staggered structure allows us to generate consistent cash flow while building long-term value, freeing us to sell, hold, or refinance based on what the market demands, not arbitrary dates.

You might be thinking, “Sounds too good to be true.”

We hear this a lot—and honestly, we get it. Most real estate funds make you wait years to see a return. Most don’t offer flexibility, and most don’t treat investors like owners. So when we say you’ll start earning next quarter, share in the upside, and have the option to exit after year three, it raises eyebrows. That’s fair.

But the truth is, this model wasn’t built for optics. It was built by people who don’t just manage real estate—they manage it well, at scale—and wanted a smarter place for their own capital. Now, it’s open to investors like you.

Frequently Asked Questions

Your AtThe details, the numbers, our track record—it’s all in the Investor Kit.tractive Heading

Complete the form below and we’ll send you the full Investor Kit, including how the fund is structured, details on all 21 active projects, expected returns and distributions, and our founder’s real-world track record.